Pavan Sathiraju-

As the day started, ALL the Adani stocks hit the lowest possible level for today (the lower circuit on the stock market).

And these are the fundamental reasons!!

Debt:

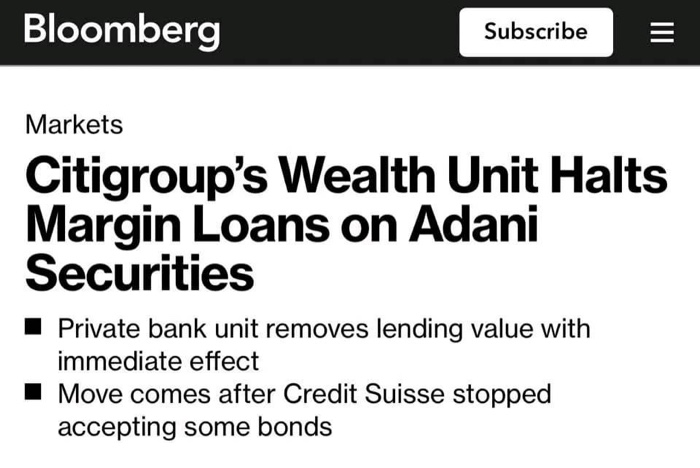

1) Last night, Credit Suisse released a report stating that “Credit Suisse has stopped accepting bonds of Adani group as collateral for margin loans”.

So what?

Reason #1: Most of the Adani companies are not generating a substantial amount of Free Cash Flows (FCF) to fund their operations. They need to BORROW money to continue growing.

- And because of the Credit Suisse report, It is becoming clear that there is increased scrutiny & raising debt is not going to be easy.

Reason #2: Also, not just for growth. They need to refinance their loans which are on high-interest rates.

- Since their existing loans are in the US bonds market, with this Credit Suisse news – It becomes difficult to refinance especially from the international markets.

Equity:

1) The 20,000 crore money raised through FPO has been returned back last night.

So what?

Rationale #1: If they are not able to fund growth through “Borrowings”, they have to fund growth by giving out equity.

- And unfortunately, the retail investor community is not interested.

- The FPO was subscribed by 100% BUT, the retail participation was extremely low.

Rationale #2: This means the money they raised was from very few individuals/entities & which is risky because if one of them is selling, the market will crash once again.

1) This is an EXTREMELY sensitive moment for the entire Indian Stock Market because, if a major player is taking a hit – There will be repercussions in the entire market.

2) If they STILL need to borrow (which they need to), the interest rates are going to be VERY HIGH & which will reduce the return on capital. Which will once again increase the interest rates.

3) I still believe at a fundamental level, Adani ports is a great company because – They are a monopoly in a business that has high barriers to entry & they are the only company within the Adani conglomerate that was praised by Hindenburg research.